Daimler-backed Momenta says its robotaxis will be fully driverless and profitable in 2024

In China and the U.S., there’s much debate about when and how humans will achieve fully autonomous robotaxis at scale — cars that chauffeur passengers under complex road conditions without safety drivers behind the wheel.

Many pieces are needed to make this happen: mammoth amounts of test data, advanced algorithms, strong operational teams, big checks from investors, local policy support, to name a handful. Until that day arrives, the bold claims from players in the field seem mostly out of reach.

One recent pledge came from Momenta, one of Asia’s most valuable artificial intelligence startups and the country’s first autonomous driving company to reach the $1 billion unicorn valuation back in 2018. The four-year-old startup, which specializes in software solutions for autonomous vehicles (AVs), told TechCrunch recently that its entire robotaxi fleet will operate without safety drivers in 2024, while some of its vehicles will already be driverless by 2022.

Competition in AVs is intense. Alphabet’s Waymo told customers last October that its completely driverless cars “are on the way.” Tesla planned to launch a robotaxi network in 2020. In China, Toyota-backed Pony.ai now offers autonomous ride-hailing service with safety drivers in two cities. SoftBank-backed ride-hailing leader Didi just began testing a robotaxi service in Shanghai.

An expensive pursuit

The autonomous cabs we now see around the world are mostly trial programs running in designated areas. Most self-driving companies build their own fleets from the ground up. The business is cash-hemorrhaging and commercialization is still years down the road, so the question is who can make it work before running out of cash.

“The expense [of building car fleets] is even unbearable for a multi-billion-dollar company like Baidu, let alone startups like us. But it may be possible for Waymo’s size,” said founder and chief executive Cao Xudong, who appeared in a plain white t-shirt on a Zoom call with us.

The 34-year-old founder previously helped launch face recognition giant SenseTime’s research division after a stint at Microsoft’s reputed Asia Research arm, which has trained many of China’s top AI brains and entrepreneurs.

Uber’s IPO prospectus revealed its self-driving unit was burning up to $20 million a month. Waymo’s valuation was slashed 40% by Morgan Stanley last year citing concerns of cash burn.

Cao claimed that his company can achieve full vehicle automation while keeping costs manageable for a startup like itself. While Momenta couldn’t reveal whether it’s actively fundraising, it said it has a “stable cash flow” that will last for at least three more years. The company had raised over $200 million by 2018.

Cao Xudong (far left) posing with municipal officials at an inaugural event for Momenta’s robotaxi program in Suzhou. Source: Momenta

Before diving into Momenta’s expenditures, it’s important to note that none of its progress can happen without state support. In its transition from traditional manufacturing to a tech-driven economy, China has made large sums of government-guided funds available for players in strategic industries such as 5G and artificial intelligence, which, of course, includes autonomous driving.

More recently, Beijing moved to speed up the development of so-called “new infrastructure” like data centers and 5G networks to offset COVID-19’s economic impact. These are basic facilities necessary for AVs, said Cao, and the policy push will certainly give China’s autonomous driving sector a strong boost.

The government is also clearing regulatory hurdles for promising AV operators. Just this month, Momenta secured the first license to recruit passengers for its robotaxis running on chosen public roads in Suzhou, an affluent and historic city bordering Shanghai that houses its sprawling 4,000-square-meter headquarters.

A sustainable path to automation

Unlike many peers in its field, Momenta depends on partners to deploy technology and reap data rather than owning its own fleets. While forms of collaboration may vary case by case, its robotaxi service will largely be a joint effort with automakers, which will likely provide vehicles and importantly, driver data; local governments, which can provide infrastructure like 5G networks; and itself, which develops self-driving software.

“If you have one million cars, which each costs a few hundred thousand RMB, that accrues to hundreds of billions of RMB. It’s no small money,” Cao contended.

Right now Momenta is working to solidify its alliance in Suzhou, where we rode in one of its trial AVs last year. While the startup aims to achieve full automation eventually, it’s not getting rid of all safety personnel.

“We will take advantage of 5G infrastructure and have remote safety staff who will each be monitoring, say, ten cars. Thus we will lower the cost of safety managers to one-tenth of its current level,” said Cao.

When all of its vehicles go driverless in 2024, the company will have significantly reduced labor costs and reach a positive operating margin per vehicle, the founder forecasted. If things go as planned, it will also roll its light-asset model into other cities outside Suzhou, entering a period of “enormous growth.”

“It’s a bit like MacDonald’s franchising model. We will come up with a set of operational standards and replicate them in other cities, where we will collaborate with the local government, taxi services, operational companies and et cetera,” said Cao.

Momenta also uses less expensive sensors, what the founder called “mass-produced” ones such as millimeter-wave radars and high-definition cameras as opposed to expensive LiDar sensors. Elon Musk would agree with his choice, having blared that “anyone relying on lidar is doomed.”

The startup procures core hardware parts from international and domestic vendors, counting NXP, Nvidia and Texas Instruments as its semiconductor partners. Cao declined to comment on the ramifications of ongoing U.S.-China trade tensions, but it’s not hard to see how sanctions from D.C. could choke the startup’s relationships with its suppliers.

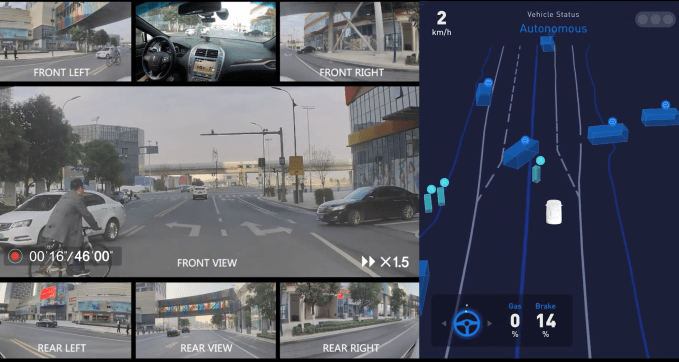

Momenta’s autonomous driving test in a commercial district. Source: Momenta

The other cost-cutting tactic is automation, which allows the company to minimize the number of engineers. There are nuances in this seemingly simple principle though.

“I’ve repeatedly told our R&D team that they are hired not as problem solvers but as architects. Why? Because Level 4 [autonomous driving without human input] involves long-tail scenarios,” the founder explained enthusiastically. “You may be presented with millions of problems. Sure, we can solve 100 problems with 100 people, but we can’t hire one million engineers to answer one million questions… So if you can build an automatic problem-solving system, automation will take care of a lot of the work for us.”

Control of data

To get ahead in the AV race, contestants need to accumulate a large quantity of data to train up algorithms. Knowing it doesn’t enjoy the financial prowess to deploy thousands of robotaxis, Momenta has been selling autonomous driving software to traditional OEM partners and Tier 1 customers, which not only supply it with data but also a steady stream of revenue.

Once the partners’ vehicles go out on the market, driving data begins pouring in, and Momenta will input that data into algorithmic training and periodically upgrade the autonomous cars for consumers.

This setup — getting reams of data at low costs — sounds ideal in theory, but it has one big red flag: the data, which is the lifeblood of any AI company, belongs to auto companies, not Momenta. Cao didn’t seem concerned, arguing that the partners are incentivized to hand over data because Momenta can offer the advanced technology absent in traditional carmakers.

The field of view of Momenta during autonomous driving. Source: Momenta

“When we can extract data from customers’ long-tail problems to train our algorithms, their autonomous driving systems will consequently be improved. We are essentially creating value for customers,” Cao said with an air of confidence.

Working with outsiders also forces Momenta to juggle competing needs. Its business is no longer just about throwing money at R&D. Having customers means it needs to consider what makes commercial sense for automakers, from the choice of sensors to software solutions.

“The auto industry thinks very differently from the internet industry. You can’t ask carmakers to adapt to your way,” reckoned Cao. As such, he’s hired a considerable number of auto industry veterans, including business development managers with years of experience at Mercedes Benz and Toyota.

Momenta has been reticent about its list of clients, though Cao hinted to us last year that there weren’t many because partnerships in AVs necessitate close and resource-intensive collaboration.

So far, we know Momenta is developing high-definition maps for Toyota’s AVs. The startup also counts Daimler as a major investor, which kicked off its AV strategy in 2017, though it wouldn’t disclose whether the German auto giant is a client. Daimler’s website offers a clue, listing Momenta under its portfolio managed by the “M&A Tech Invest” team, which is responsible for technology and startup acquisitions for the world’s leading premium car brand.

from TechCrunch https://tcrn.ch/31vMD1O

#TTC

No comments: